Fear & Greed Index

Why Measure Fear and Greed?

The crypto market behaviour is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With our Fear and Greed Index, we try to save you from your own emotional overreations. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, we analyze the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. See below for further information on our data sources.

For more information click here.

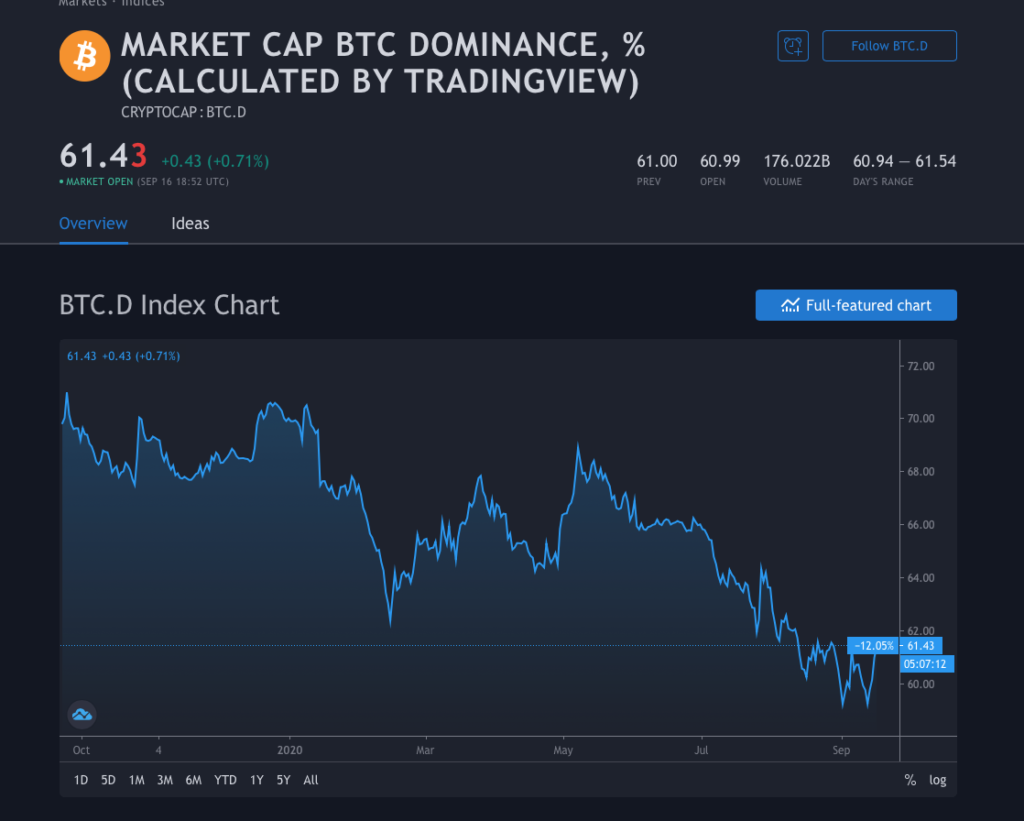

BTC Dominance Chart (%)

What is the Bitcoin Dominance?

Bitcoin is the most dominant cryptocurrency at the moment. Therefore knowing how dominant Bitcoin is at the moment helps us in identifying upcoming market movements. If Bitcoin’s dominance increases, there is less investing in the other cryptocurrencies and we can expect their price to go down. Alternatively if Bitcoin dominance decreases there is more investing in the other cryptocurrencies and we can expect their price to go up. For the current BTC Dominance chart please click here.

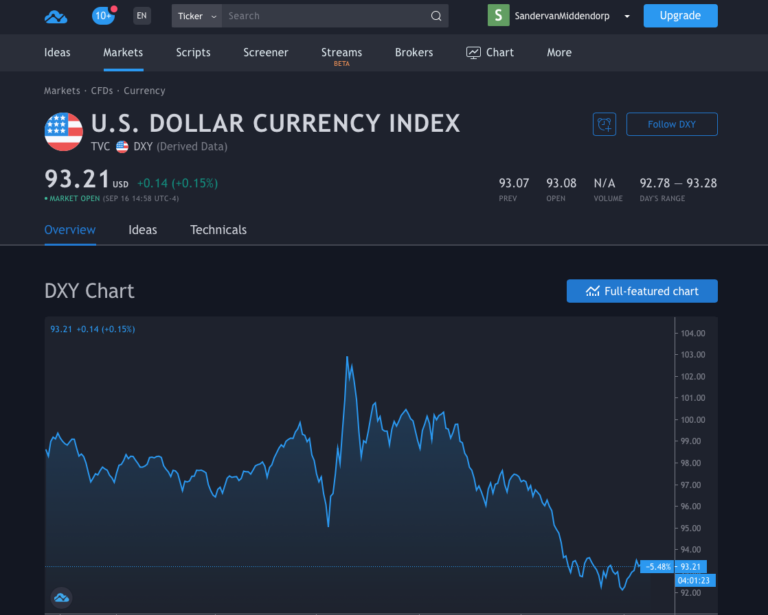

U.S. Dollar Currency Index

Why do we use the U.S. Dollar Strength Index?

The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies. (DXY) originally was developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar against global currencies. U.S. Dollar Index goes up when the U.S. dollar gains “strength” (value), compared to other currencies. The following six currencies are used to calculate the index:

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

What does the U.S. Dollar Index have to do with the cryptocurrencies? When the U.S. dollar loses strenght (value) investors do not like holding big amounts of cash. Therefore these are invested in other markets like gold and cryptocurrencies.

For the actual U.S. Dollar Strength Index chart click here